NPS Vatsalya Scheme : Finance minister Nirmala Sitharaman recently launched the NPS vatsalya scheme on 18 September 2024, which has been implemented to strengthen the financial condition of children. NPS Vatsalya Scheme is extended from the national pension scheme. Under this scheme, an important initiative has been taken by the government to strengthen the financial condition of children the government has also launched an online platform for investment. Let us know about this scheme in detail.

NPS Vatsalya Scheme 2024

Finance minister Nirmala Sitharaman recently launched the NPS Vatsalya scheme, which has been implemented to strengthen the financial condition of children. An online platform was also launched for investing in this new scheme. Along with this, a booklet was also released for better understanding of this scheme.

Under this scheme, minor subscribers will be given permanent retirement account number (PRAN) cards. Latest understand this scheme in detail. It works just like NPS, which helps people to create a retirement fund by contributing during their career.

NPS Vatsalya Scheme 2024 Highlights

| Scheme name | NPS Vatsalya Scheme |

| Launched by | Finance minister Nirmala Sitharaman |

| Launch date | 18 September 2024 |

| Objective | Strengthening the financial position of children. |

| Year | 2024 |

| Mode | Online |

| Official website | https://enps.nsdl.com/eNPS/NationalPensionSystem.html |

What is the method of investment in NPS Vatsalya Scheme

NPS Vatsalya Yojana allows parents to contribute to the child pension fund. Which will provide them financial security for their bright future. For your information, latest style you that it was announced in the union budget Scenario 2024-25.

Features and Benefits of NPS Vatsalya Scheme 2024

- Parents aur guardians can open NPS Vatsalya Scheme for their minor children, who will be its sole beneficiaries.

- The NPS Vatsalya account will be operated by the guardian for the exclusive benefit of the minor till they attain majority.

- When they turn 18 they can continue the account with the accumulated amount.

- When a minor turn 18, the account will continue and will be transferred to NPS tier 1 account-all citizen model.

- When the minor turns 18 his/ her fresh KYC will be done. This will be done within 3 months of attaining majority.

- The minor can operate the account on attaining majority after KYC is completed.

- The minimum contribution to NPS Vatsalya is Rs 1000 per year and there is no limit on the maximum contribution.

- The initial enrollment contribution to NPS Vatsalya is Rs 1000.

- The NPS Vatsalya Yojana offers partial withdrawal and exit options.

Eligibility Criteria

- The applicant must be a permanent resident of India.

- The applicant must be below 18 years of age.

- Non resident Indian (NRI) and overseas citizenship of India (OCI) individuals below 18 years.

- The parent or guardian of the child can open and operate the account on behalf of the minor.

- The parent or guardian will be the nominee under the scheme and the child will be the sole beneficiary.

Required Documents

- Proof of identity for guardian (Aadhar card, PAN card, passport or driving licence etc).

- Proof of address (any Official Document which confirm the current address)

- Proof of identity for minor.

- Proof of age for minor

- Mobile number

- Email ID

- Passport size photograph

NPS Vatsalya Scheme Online Apply

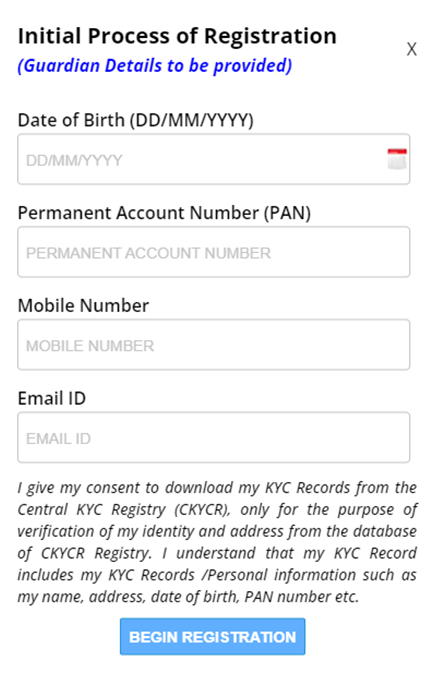

- First of all you visit the official website of this scheme.

- Now the website homepage will open in front of you.

- On the homepage scroll down and click on “Register Now” option under the NPS Vatsalya Scheme.

- Enter the guardians date of birth, PAN card number, mobile number and email ID.

- After entering all this information you have to click on Begin Registration.

- Enter the OTP received on the guardians mobile number and email.

- Once the OTP is verified, the acknowledgement number will be generated on the screen click on continue.

- Enter the minor’s and guardians details, upload the required documents and click confirm.

- Make an initial contribution of Rs 1000.

- PRAN will be generated the NPS Vatsalya account will be opened in the name of the minor.

Withdrawal and Exit Rules of NPS Vatsalya

- Parents or guardians can withdraw after 3 years of joining NPS.

- They can withdraw up to 25% of the amount contributed.

- With the role option is available only three times till the child turns 18.

- They can withdraw for education, disability of more than 75% treatment of specified diseases, etc as specified by PFRDA

FAQs

What is NPS Vatsalya Scheme?

An investment plan to secure retirement savings for your minor children.

What is the amount given under NPS Vatsalya Yojana?

Rs 1000 per annum.

When did the NPS Vatsalya Scheme start?

18 September 2024.

Who is eligible for NPS scheme?

You should be between 18 and 70 years of age as on the date of submission of your application to the Pop/Pop-Sop, or online through e-NPS.